Medicare Disadvantage

by Joe Brreault MD, ScD, MPH on March 14, 2024

Physician friends, family, and patients often asked me about medicare choices and my experience as they get close to 65. What is best to do?

When it was time for my wife and I to get on medicare, after reviewing the options she decided to do original medicare with a medigap plan, while I signed on for a medicare advantage plan. My reason was saving money - her original medicare costs were almost $250/mo in premiums more than mine or $3,000 a year. Her reasons for wanting to go on original medicare was she was hoping to travel, and wanted a PCP in a new place as well as New Orleans. Also, no need for approval to see specialists, including when she traveled, as long as they accept Medicare.

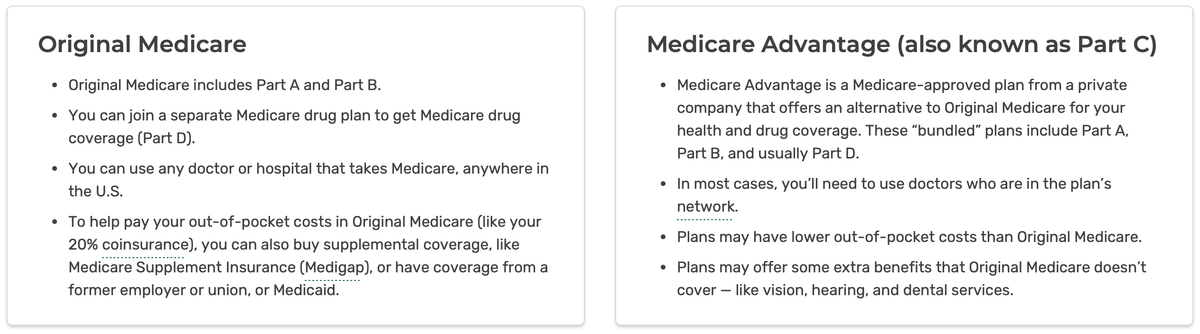

Medicare Parts A, B, C, D

Medicare part A covers hospital costs with no monthly premium cost to you, though there may be deductibles. Medicare part B covers doctor services, outpatient care, durable medicare equipment, and many services not covered by part A. But it only covers 80% of the costs and the other 20% is out of pocket. So if you have a bad year with $100K in non-hospital bills, your 20% out of pocket is $20K that year. Medicare part D pays for drugs. Medicare advantage plans roll up parts A, B & D into a private plan (called part C) with additional benefits that cover the medicare part B 20% gap substituting co-pays for services and limits about the max out of pocket to be paid. Medicare pays the private plans to manage the care, and their profit is made by care management, a limited in-network set of doctors & hospitals, and a prior authorization system that reviews anything expensive before they approve it.

As with all medical insurance, medicare only covers what is medically necessary and may have exclusions. While a patient may believe something is medically necessary, it depends on medicare rules. Plastic surgery, for example, is generally excluded. Long term care is not covered.

Medigap Plans A, B, C, D, F, G, K, L, M, N

For those in original medicare (parts A & B), there is the part B 20% out of pocket gap to take care of. Medigap plans that cover that 20% part B gap have federal requirements to offer a set suite of benefits for plans A, B, C, D, F, G, K, L, M, N that can be reviewed here. Medigap monthly premium prices depend on which medigap plan you choose, your residence location, and age. If you are outside the grace period (e.g., the months after you turn 65, or losing your employer insurance when you retire at an age over 65) the cost can go up if you have pre-existing conditions or even deny coverage (unless you live in one of the few states that forbid it, see here). Unless you turned 65 before 2020, Plan F is no longer available.

My medicare advantage plan came with extras like a gym membership, but so did her medigap plan F policy. Neither of us had any chronic illnesses. We both had to pay medicare part B premiums with the IRMMA increase due to our income (more on that below).

Medicare Disadvantage (Part C)

In the few years I had medicare advantage, I saw more bad things happening with my patients on medicare advantage plans that changed my mind and I switched over to regular medicare. In one case...

...an elderly patient told me her husband had a bad stoke. The hospital doctors told her they thought it was medically necessary to spend a substantial time in a rehab skilled nursing facility to get his function back through daily intensive work. The family agreed. The patient was on a medicare advantage plan, so the doctors had to get approval from his insurance. It was denied, even after appeals. Instead the patient was given home health. This could limit how well he recovered and how good the rest of his life would be.

This is not an isolated or rare instance. "Hospitals are dropping Medicare Advantage plans left and right" according to a report here. It says: "Among the most commonly cited reasons are excessive prior authorization denial rates and slow payments from insurers. Some systems have noted that most MA [medicare advantage] carriers have faced allegations of billing fraud from the federal government and are being probed by lawmakers over their high denial rates." As one hospital executive was quoted, " Traditional Medicare is not an issue." The issue instead is that doctors can't get the patients the care they need due to medicare advantage delays and denials, and the medicare advantage payments are not adequate to cover the cost of the services.

I saw many patients of mine get denied for an expensive procedure or scan. Sometimes these could be reversed on an appeal or a second appeal, but sometimes not. Even when reversed the delay could be weeks or even months. If a suspicious lesion is found that turns out to be a cancer, what does the delay cause? And due to the paperwork involved in prior authorizations, appeals may not even be pursued by the patient.

Advantage to Original Medicare

In contrast, original Medicare does not generally require approvals. Doctors can order whatever they deem medically necessary. Medicare oversees it by an after the fact audit of an institution when they see bad patterns and can levy large fines in the millions the institution has to pay if the audit shows unnecessary care being billed to medicare. But for the patient, they can get their test, scan or be sent to the rehab facility immediately without a prior authorization. Institutions do have people and electronics that check the diagnosis codes and situations against medicare rules to assure it will pass a medically necessary audit, since they don't want a painful and expensive medicare audit and fine. But as long as something is really medically necessary and meets medicare rules, it is not a problem.

As I saw more and more of the prior auth denials among my own patients in 2020-2022, I decided it was worth the medigap plan costs to switch over to original Medicare. God forbid we were in a serious accident or had a major stroke or other event that needed intense rehab for months, or an expensive procedure or scan a prior auth would deny, it did not seem worth the risk for denial or delay.

Luckily I was able to switch and got the same plan F my wife had for the same price. Medicare parts A & B will always accept you if you want to switch, but the medigap plans (to pay the 20% of outpatient costs not covered by part B, and perhaps additional coverage beyond that) are private plans that can reject you unless you are in a grace period such as soon after turning 65. When they do accept you, they can charge you more if you are not in a grace period depending on your pre-existing conditions. Luckily I had no significant health issues and got accepted on the same plan my wife had for the same cost.

Part C Limits Your Options

Another advantage to original medicare is being able to see any doctor that accepts medicare without needing a referral. So, if you develop cancer and want to go to MD Anderson for treatment, that would be covered under original medicare, but probably not by most part C medicare disadvantage plans. If you need a hip or knee replacement or spine surgery and want to go to the #1 ranked hospital in the US for ortho in NYC, it would be possible. Of course, most people would prefer to get care closer to home without extra travel and hotel costs, but you would have options if you wanted them under original medicare. There would be no medicare disadvantage plan denying it and only covering you to use only in-network hospitals and doctors.

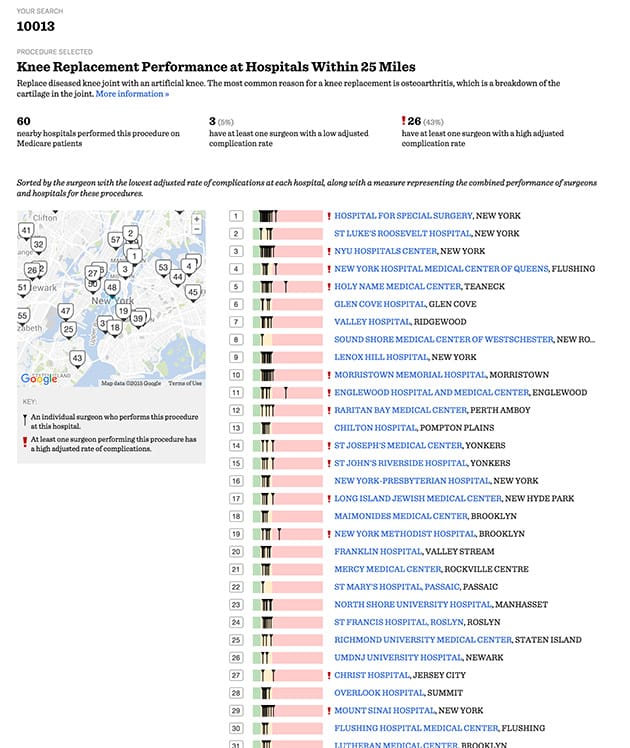

If you need major elective surgery, you might want not only the safest hospital near you to have the surgery, but you also need to find one of the safest surgeons at that hospital. A ProPublica article that talks about this states: "analysis of Medicare data found that, when it comes to elective operations, it is much more important to pick the right surgeon [than the right hospital]." The ProPublica surgeon scorecard, while controversial among surgeons, provides this data (see example in the image below). Even if staying near where you live for surgery, it might be wise to select a hospital and a surgeon with a low complication rate for the type of surgery you are having--but they may be out of network in a part C medicare disadvantage plan.

Cost Advantage to Medicare Advantage

We were in a financial position to afford the medigap plan premium costs. Many cannot afford a few thousand more in medigap costs annually in addition to the plan B premium costs. This tends to force financially strapped patients into medicare advantage plans without having the option we took. Medigap costs can vary greatly depending on which plan is chosen, the location, and age.

Unless your enrollment is in a grace period (or you are in the few states that disallow it), pre-existing conditions can increase the cost or even cause denial of medigap coverage entirely. So, address what you want to do as soon as you turn 65. If you have qualifying employer insurance, you may have a grace period once you lose that, even if you are over 65. But check the rules as private medigap insurance is largely regulated by states with rules varying by state, except for the details of what medigap policies must cover once the policy is issued, which is set by the feds.

Some Can't Afford Part B Premiums

Some of my elderly patients did not qualify for medicaid, but did not have medicare part B because they could not afford the part B premiums. Part A is free to most over 65. Part B is optional and requires monthly premiums. The 2024 part B premium is $176/mo for those who meet certain income limits, and higher in a graduated fashion based on income above the limits (see here). The part B premiums must be paid to qualify for medicare advantage plans also - so there is no way of getting out of paying part B premiums if one is to have adequate health insurance (unless income is so low one qualifies for medicaid, which can vary widely state to state).

These patients avoided doctors, blood tests, scans, and ERs except in a crisis to avoid getting bills. Part A covers hospital care as an inpatient, but an ER visit is not covered by part A unless it results in being admitted to the hospital as an inpatient. Even a short hospital stay as "observation" is not covered by part A. Outpatient visits are paid by part B. Those without part B will, therefore, get a large bill for ER visits that don't result in admission to the hospital as an inpatient and are sometimes surprised with a big bill when even an overnight in a hospital was classified as "observation" not inpatient status. The rules can be complicated and are explained here.

One Medicare patient in the news last year was transferred from a rural hospital to Vanderbilt by air ambulance for a stroke. She did not have part B, which would pay for that. The air ambulance bill came to $81K. After her death, the estate was expected to pay it. Though her finances were limited, her house and land may go to an insurance lien before any of it goes to her family. The full story is here.

IRMMA

Medicare part B premiums increase with income, regardless of whether one is in original medicare or medicare advantage. This is called IRMMA (Income-Related Monthly Adjustment Amounts) and is set by the feds annually. It increases the cost of part B and D premiums. The medicare site explains:

"Since 2007, a beneficiary’s Part B monthly premium has been based on his or her income. These income-related monthly adjustment amounts affect roughly 8 percent of people with Medicare Part B. The 2024 Part B total premiums for high-income beneficiaries with full Part B coverage are shown in the following table:

Table - Full Part B Coverage

| Beneficiaries who file individual tax returns with modified adjusted gross income: | Beneficiaries who file joint tax returns with modified adjusted gross income: | Income-Related Monthly Adjustment Amount | Total Monthly Premium Amount |

|---|---|---|---|

| Less than or equal to $103,000 | Less than or equal to $206,000 | $0.00 | $174.70 |

| Greater than $103,000 and less than or equal to $129,000 | Greater than $206,000 and less than or equal to $258,000 | $69.90 | $244.60 |

| Greater than $129,000 and less than or equal to $161,000 | Greater than $258,000 and less than or equal to $322,000 | $174.70 | $349.40 |

| Greater than $161,000 and less than or equal to $193,000 | Greater than $322,000 and less than or equal to $386,000 | $279.50 | $454.20 |

| Greater than $193,000 and less than $500,000 | Greater than $386,000 and less than $750,000 | $384.30 | $559.00 |

| Greater than or equal to $500,000 | Greater than or equal to $750,000 | $419.30 | $594.00 |

..." If you read further down on the website, there is also an IRMMA for medicare part D (drugs) monthly premiums.

So for a couple who were very well off, making more than the maximum upper levels of the IRMMA tables, the cost for original medicare might be:

- $594/mo for plan B premium per person = $14,256/yr for the couple

- Perhaps $250/mo per person for Medigap = $6,000/yr for the couple (can vary)

- Part D base premium (can vary widely)

- Part D IRMMA of $81/mo per person = $1,944/yr for the couple

- An option of perhaps $47/mo per person for a seperate dental insurance outside of medicare = $1,128/yr for the couple

For a total of $23,328 yearly plus whatever the deductible and co-pays would be. The part B premiums with IRMMA and the part D IRMMA must be paid regardless of whether one chooses medicare advantage or original medicare. If you are in the lowest income bracket, so IRMMA does not apply, then the part B and D premiums would be lowered by $675/mo per person = $16,200 less per couple yearly than the highest income levels would pay. Medigap may be less expensive depending on age, location, and which plan is chosen. Separate dental coverage (outside medicare) is optional, and might not be needed on some medigap plans or plan C programs

IRMMA Tax Planning

IRMMA is a surcharge (i.e., tax), and one penny over the income limits triggers a much higher part B & D premium payment. Therefore, it is good tax planning to try to stay under the limit. IRMAA is calculated using your MAGI reported on your IRS tax return from two years prior. So your 2023 tax filing has the MAGI that determines your IRMMA tax in 2025 (in the form of higher medicare part B and D premiums).

There are a few ways you might reduce the IRMMA cost. One is by reducing your MAGI with methods described in the link. You might consider a QCD to reduce your RMD if that brings your MAGI below an IRMMA threshold. Finally, if there is a major change to your income, say your 2024 income is much lower because it is your first year of retirement, you can appeal your 2024 IRMMA instead of waiting for 2026 for the lower IRMMA to kick in. Fill out form SSA-44 and bring to your local Social Security office. A significant amount of money (IRMMA tax) can be saved if the appeal is successful.

Drugs - Medicare Part D

If you go with original medicare to avoid prior authorization denials, delays, limited networks, etc., you will need to buy the optional medicare part D to cover drugs costs. The cost of plan D drug plans and what they cover are complicated. See the details here. This article will not be going into part D drug coverage and cost details.

For more medicare information, review the official US government medicare handbook.